UPDATE: This link is relevant to the discussion below. https://noconsensus.wordpress.com/2012/03/17/conservative-fantasy-world/

——

Tom Fuller and I have always had a cordial relationship despite the fact that his politics are Pelosi-left. He left a comment on the last thread in relation to taxes and the deficit which depicts exactly how the left-wing media is trying to portray our current debt situation. While he is refreshingly honest in his beliefs, they do not match objective reality.

Hiya Jeff (and all…)

If I can focus first on the debt argument here, I must say I am not at all worried by American levels of public debt.

Our debt has been higher in the past as a percentage of GDP, which is the only sane metric to use. The people who are lending us money are in line to do so. They have more confidence in our ability and intention to pay than maybe you do. They like us so much they’re willing to lend us money at effectively zero interest.

If America were a ‘household’, its debt would be considered very manageable–a bit more than 100% of annual income. Anybody reading this who has a mortgage may well hold a much higher percentage of debt.

What worries me is that our obligations are set to grow dramatically, to help seniors stay out of poverty and get some sort of medical care. That is why I am not overly upset at taxes returning to levels last seen during the Clinton administration, when we managed to grow the economy quite well, even with taxes at a respectable level.

We’ve had much higher debt in the past and done just fine. We’ve had much higher taxes in the past and done just fine. We have problems ahead that we need to prepare for–but we can and we will.

Happy New Year!

On Taxes

Now the only time in history that debt hit a higher percentage of GDP in the US was in WW2. I like this first graph because it doesn’t try to blame one party or the other for spending but it does show how serious the situation is in recent years. Everyone likes to hate Bush Jr. because that is what is popular today, but unlike most people, my beef with him was that he didn’t fight congress enough on spending. You can see that as a percentage of GDP, he barely tweaked the debt level until the last two years of his presidency when the Democrats controlled two branches of government and massive spending bills were passed under the false guise of “saving the economy”. The 2012 point at the end of the graph is an out-of-date estimate.

So when you look at that plot, the only time we had a debt level this high was when we were in the middle of a world war. Not just an ordinary little war, a world-wide battle for our lives.

The next graph shows the continual cancer-like growth of the largest and most powerful government in world history as a percentage of its populations Gross Domestic Product (GDP). Note that the plot is of “total government receipts” rather than the receipts from income tax so popular in leftist newspapers. Receipts from income tax have remained flat, and the media continually confuses its audiences with this tax fact that represents a small fraction of the picture. Total government receipts, is the Federal-only tax load on the economy in dollars, and does not include State taxes. When discussing historic tax levels, this is the majority of the real tax that you should be looking at, as these are the actual tax dollars being sucked out of the “free market” by our “limited” central government.

Tom wrote – “We’ve had much higher taxes in the past and done just fine.”. While his opinion that taxes were “much higher”, is an admittedly widely held belief, it is flatly incorrect. The total governmental tax load on the US economy is the highest it has been in history, and as Tom pointed out, the future load already put into law is much greater.

So the next time you hear that US taxes were much higher in the past….

Now there are a number of countries with higher receipts as a percentage of GDP than this, that the left likes to use as examples. However, these countries are either very much business repressed or in unusual economic circumstances like Denmark experiences, where exports provide the funding to allow a relatively successful left-wing society on a very tiny scale. I like the Denmark example because its often used as a counter example to a US style of government, yet it is comprised of 5 million people who are ironically dependent on oil and gas for their funding. There is nothing wrong with that in my opinion, but it cannot be scaled to function here as the amount of gas and oil required to support the same system for 300 million people would quite literally “flood” the market. You might even need an actual boat! We also have that little problem that the left seems to think CO2 emissions are killing the planet so instead of moving forward with common sense production of gas, there is great resistance to it.

On Causes

I like this next graph taken from usgovernmentrevenue.com. It depicts several of the primary sources of income for the US governement and you can see fairly clearly where the increases in figure 2 above come from.

The blue line is total revenue, red indicates income taxes, green is business and other revenue, gray is ad valorum (property tax), and yellow is social security/medicare tax. Now we often look at the volatility of a timeseries while studying climate here, note the extreme fluctuations at the most recent end of the graph. These are caused by dynamics in the economy as the government borrows and spends to try and prop up our over-taxed free market economy. Notice the business and income taxes are the lines which create the recent short term variability in the total, not the social tax, and not the property tax. These taxes are profit based tax, rather than asset based. This fluctuation represents extreme losses of income in the private sector (loss of profitability). This income loss was unequivocally created by government loads on the economy which come in all forms. e.g. People like to say the housing “bubble” was the cause in 2008, but providing housing to those who couldn’t afford it, was just one of the many government loads created nearly exclusively by the Democrat party in the interest of fairness. Of course there are other examples as well but that one is a pet-peeve of mine.

One theme here is that ever-tightening regulations are also taxes on the economy. These costs are true and real expenditures from business (taxes), and real checks are written to pay for them, yet the increases in cost are not shown in the plot above. These costs should not be ignored lightly but are difficult to quantify as they are not easily tracked. I find that today’s anti-industry climate makes the Democratic party completely deaf to the consequences of these realities, and while we are about to experience them in very clear and unfortunate economic terms over the coming decades, the yellow journalism of today will not discuss the problem.

On Debt

So now that we have figured out that taxes as a percentage of the US economy have never been higher, let’s look at the total government debt. Tom wrote, “We’ve had much higher debt in the past and done just fine.” This seems reasonable at first glance but let’s look a little closer at figure 1. In World War II, the US debt skyrocketed over 4 years from 52 percent to 121 percent of GDP. This expenditure was massive and I think even most Germans of today would admit it was necessary. Reading an expanded view of the graph, the WWII expenses took 16 years under a booming economy to pay them off to pre-war levels. Our net government revenue at the time was under 25% of GDP, and the hidden social/regulatory costs to operate a business were far lower than today.

So in reality, we paid much less tax in the 50’s than today and it took over a decade to recover from the WWII expenditure in a booming economy. To me this indicates that Tom is right, we can recover from our current debt, yet in order to do it we have to bring government spending, anti-business regulations and taxation down dramatically. If we don’t reduce business regulation, the same government revenue means that you have a hidden net-higher rate than a numerically comparable rate in history.

Let’s look again at Figure 3 above to see if we can tell what is responsible for our currently massive tax levels. After WWII, income taxes were increased dramatically. Overall tax rates were low enough that the economy continued to grow, yet this is the time when Social Security programs were enacted. Social Security was a liberal social program designed with the best intention and the yellow line represents the tax level for social security as a percentage of GDP. What I notice is a continued growth of social security income to nearly ten percent of the total economy before 1990. Visually this represents the majority of the federal tax increase between 1960 and 1990.

I am pretty sure that we are fully stuck with the SS and Medicare tax for the foreseeable future, yet it is very clear that by looking to emergency spending of WWII, we are overspending in an unprecedented manner. Don’t forget that even with the high taxes, the social programs are famously under-funded.

Together these plots show that we are currently spending more money as a percentage of GDP than we were in WWII and that taxation growth up to 1990 was largely a function of liberal social programs. In WWII, we were smart enough to stop the spending and rebuild our economy. At that time, we had reduced tax law that favored manufacturing and did not have the insane employment laws, environmental laws and compliance costs we have now. The plots indicate to me that nothing about the US situation is even remotely similar to history. The addition of an underfunded Obamacare expense to our budget is a guarantee that everything will not just be alright in the future either. To sum up, we have government expenditures in excess of a WWII scale, during peacetime, with nothing but increases in spending and taxation as far as the eye can see.

What’s more is that the information in the graphs above, combined with the present recession, is a strong indicator that we are on the wrong side of the Laffer curve. Ignore that little detail at your own peril.

On Debt vs GDP

So Tom then wrote this statement which also needs discussion: “If America were a ‘household’, its debt would be considered very manageable–a bit more than 100% of annual income. Anybody reading this who has a mortgage may well hold a much higher percentage of debt.”

This is also a complete misnomer often sold by left-wing media that many reasonable people believe. Gross Domestic Product is not “Income”, it is gross sales. The profit on GDP is Income, and it is a tiny fraction of GDP. The comparison is therefore a non-sequitur. If you sell a box of oranges to your friend for the same cost at which you bought them, how much of your personal GDP (gross sales) from the oranges, is available for payment of debt?

It is more sensible to look at the national debt other ways. If we take the 16 trillion of debt and divide it by the 300 million population, we get a nice low number of $53,000 usd per man, woman and child. This is not a bad number to work with and doesn’t sound insurmountable by itself. Unfortunately, only working people pay taxes, and they only work for a fraction of their lives. Currently we have about 110 million employed people in the US which brings the total debt that working people owe to the government to 145,000 dollars per working person. There are about 110 million households so this is very similar to the dollars owed per household as well.

But the annual deficit is what contributes to debt, and our government spending is so massive that and we are presently borrowing $10,000 per household per year. This means that every home needs to send $833 more per month to the federal government in taxes just to break even with our current expenses, and does not include the coming spending increases with Obamacare. Most readers will agree that that is a fairly huge amount of money for the government to be borrowing on our behalf during peacetime. Those households on social security would really need to tighten their belts to pay that bill.

None of this includes the also massive debts being incurred by left-wing State governments like California and Illinois. Illinois currently carries a debt of 55,000/private worker for example.

The financial situation of this country is terrible. The latest tax bill was full of payoffs to left-wing campaign supporters for Obama. I have never witnessed the kind of quid-pro-quo corruption of his administration, like Benghazi, that doesn’t even make a footnote in the media today. The media excoriates big business conservatives, then giggles as the Democrats hand out huge piles of cash to big business, right after receiving campaign cash from them.

Common Sense Solutions

While people can interpret the numbers above differently, the range of reasonable interpretation does not include the possibility that what our government is doing might somehow be ok. It doesn’t take a rocket surgeon to work out what we need to do to fix it. It also doesn’t take much of a crystal ball to see what the future will bring if we don’t change our ways.

Spend less, tax less, spend less, control less and spend less and we will all have a better future.

There’s one other aspect of Tom’s remark with which I’d like to take issue. He wrote, “If America were a ‘household’, its debt would be considered very manageable–a bit more than 100% of annual income. Anybody reading this who has a mortgage may well hold a much higher percentage of debt.”

The comparison with a mortgage is, I think, inapt. The mortgage represents a leveraged purchase of an asset, and is based on the expectation that one has excess income (above what is needed for a complementary good, rent) with which to pay it off. In a reversal in which income is lost, one can (at least theoretically) undo that transaction, selling the house and paying off the mortgage. There’s no equivalent with our government debt — it wasn’t incurred to make a purchase (say, of land) which represents an asset on the books.

A better analogy to a household would be if that household had ~100% of annual income in credit card debt, incurred to cover current expenses. That comparison makes the current high levels of debt sound much less palatable. Of course, government has a relative advantage that the interest rate is far less than a household would be forced to pay, which is to say that its risk of default is viewed as lower.

Correct. The analogy should be to a household with 100% annual income in credit card debt and expressed as percentage of after tax discretionary income.

Hi all. I don’t have my numbers prepared the way I would if this were about energy or climate, so my substantive response will be a bit slow.

I just want to start by acknowledging that my analogies were in fact quite loose and that Jeff and the two commenters are correct to call me on that. I’ll be back later with better numbers. (quick–get Krugman on the phone!)

I will be dipping in and out here, making piecemeal arguments that I hope to tie together in a grand finale later. Let’s start with the Congressional Budget Office:

“For fiscal year 2012 (which ends on September 30), the federal budget deficit will total $1.1 trillion, CBO estimates, marking the fourth year in a row with a deficit of more than $1 trillion. That projection is down slightly from the $1.2 trillion deficit that CBO projected in March. At 7.3 percent of gross domestic product (GDP), this year’s deficit will be three-quarters as large as the deficit in 2009 when measured relative to the size of the economy. Federal debt held by the public will reach 73 percent of GDP by the end of this fiscal year—the highest level since 1950 and about twice the share that it measured at the end of 2007, before the financial crisis and recent recession.”

“Over the past few years, the federal government has been recording budget deficits that are the largest as a share of the economy since 1945. Consequently, the amount of federal debt held by the public has surged. By the end of this year, CBO projects that the federal debt will reach roughly 70 percent of gross domestic product (GDP), the highest percentage since shortly after World War II.

Whether that debt will continue to grow in coming decades will be affected by long-term demographic trends (particularly the aging of the population), economic developments, and policymakers’ decisions about taxes and spending.”

“The aging of the baby-boom generation portends a significant and sustained increase in the share of the population receiving benefits from Social Security, Medicare, and as well as long-term care services financed by Medicaid. Moreover, per capita spending for health care is likely to continue rising faster than spending per person on other goods and services (although the magnitude of that gap is uncertain). Providing the health care services and retirement and disability benefits that people are accustomed to will consume a greater share of the economy in the future than it did in the past.

Specifically, if current laws remained in place, spending on the major federal health care programs alone would grow from more than 5 percent of GDP today to almost 10 percent in 2037 and would continue to increase thereafter. Spending on Social Security is projected to rise but much less sharply. Altogether, the aging of the population and the rising cost of health care would cause spending on the major health care programs and Social Security to grow from more than 10 percent of GDP today to almost 16 percent of GDP 25 years from now. That combined increase is equivalent to about $850 billion today. (By comparison, spending on all of the federal government’s programs and activities, excluding net outlays for interest, has averaged about 18.5 percent of GDP over the past 40 years.)”

More later

This is why I remain single, well-incomed, and planning on retiring to a life of sailing the south pacific cheaply. There seems to be no end to justification for entitlement spending. I have been paying into social programs my entire life without choice and I will never see a dime from them because their entire structure is little better than a pyramid scheme. Few people seem willing to simply say, “No, you can’t have these things on the debt of our children and if that means your life is less comfortable or shortened by them, so be it.”

Atlas isn’t just beginning to shrug, he’s nearly got it ready to fall of his shoulders.

“So now that we have figured out that taxes as a percentage of the US economy have never been higher,”

Jeff, As I am sure you’d agree, no single plot is good at giving a comprehensive understanding of taxation levels, revenue levels, and spending levels. Your plots here come close (and are quite good), but I have at least one disagreement. I imagine the end of the second plot shoots up because of how the GDP went down during the crash. That sudden rise doesn’t represent new taxes, just a lower GDP basis. And, if you back up right before the crash, then even in that plot you can still conclude that taxes as a percept of GDP were about as low in the 2000’s as they had been in many decades. Also, one can find analyses that do include state and local level taxes, and still rightly conclude that our total taxes are about as low as they’ve been in 40ish to 50ish years. Whether taxes have gone up, down, or stayed flat also depends a bit on which bracket. I think for the middle class they’ve been remarkably flat, but were lower for upper incomes in the last 10 years.

I fully agree we have a serious long-term spending/entitlement problem (especially now that we’ve locked in the “temporary” Bush tax cuts), but the idea that we have been taxed ever higher and higher isn’t exactly correct, just as saying they are the lowest ever isn’t exactly correct. The latter is closer to correct, but its just never as simple as absolute statements.

Our problem isn’t just taxes or just spending, as many love to say, it is clearly both. We cut taxes while increasing spending. I do agree that now we certainly must address spending. (Heck, I was tempted to think we should go over that cliff…we can’t prop up the economy on deficit spending forever…even though that is what we’ve done for most of the last 30 yearss.)

(I do agree that the mortgage is a poor analogy, btw.)

There was an editorial cartoon in the 1980’s of Reagan driving a cadilac with the words “US economy” on the hood. Some passenger was saying “sure, it runs nice, but how much debt are you running up to have this car?” I am not trying to blame him exclusively (we all know there was a Dem congress then), I am just saying this “propping up the economy” idea isn’t new, and this of course started 30 years ago. It won’t be stopped overnight.

forgive me for getting a little sloppy in my comments on that second plot wrt spending and taxes vs reciepts…but the idea holds…the sudden changes at the end were from the scaling basis changing and some new crash-related spending. There were no new big gov’t programs (outside of bailouts and stimulus bill) or new taxes…the end is all the crash. Conclusions shoudl be based on the plot right before the crash. Also, it is interesting that you can see the Bush tax cuts in that plot, which do support the “taxes are about as low as they’ve been in decades” meme.

“People like to say the housing “bubble” was the cause in 2008, but providing housing to those who couldn’t afford it, was just one of the many government loads created nearly exclusively by the Democrat party in the interest of fairness. ”

This seems a little oversimplified too, don’t you think? The investment banks and lenders committed fraud. Fraud. This was not simply the pressure from Dems to loosen lending standards. The banks went far beyond that due to the money to be made in issuing mortgage loans and then repacking them as securities. The gov’t did contribute (via backing, even if the banks went below those standards), but the degree to which the bubble inflated, and the dramatic way in which it popped…was based heavily on fraud in the financial sector. Don’t lay all the blame on Dems.

CDM, It is oversimplified but the government created the rules which the banks used to approve loans. Ross McKitrick has an excellent paper on all of the details which you can find at his website.

I’ve never been convinced that government backing of poorly underwritten loans was not a primary cause of everyone believing in the “robust”ness of those packaged securities.

Banks have never been in the habit of simply manufacturing risk for themselves that they then fraudulently sell off. They don’t do this. Lending institutions are generally always leveraged to some degree, meaning the risk of even 25% default on their portfolio can literally bankrupt a single bank in a day. Banks are always cautious, always looking for someone to buy down risk for them. The people approving the home loans were doing so under the guise of “this loan is at least partially guaranteed” by the government. This let the packagers say to themselves, “if we package the highly with the poorly qualified borrowers, we’re creating a worthwhile security because the risk of high default percentage is low.”

It was a house of cards on a card table, the government is the one that said the table was made from marble.

“Banks have never been in the habit of simply manufacturing risk for themselves that they then fraudulently sell off. They don’t do this.”

They most certainly did do this. The degree to which this caused vs merely added to the bubble and crash is open for debate, but the level of fraud or “willful ignorance in pursuit of profit” was significant.

But, that being said, like you, I also tend to think the “blanket” backing by Fannie/Freddie surely had a large role in banks doing this. Now, that is not completely accurate—banks did go below Fannie/Freddie standards and FF have been recovering billions over it…but it still seems like the Fed backing set up the conditions. (Along, of course, with monetary policy and a dozen other smaller factors not necessarily the Fed’s fault.)

“The banks went far beyond that due to the money to be made in issuing mortgage loans and then repacking them as securities. The gov’t did contribute (via backing, even if the banks went below those standards), but the degree to which the bubble inflated, and the dramatic way in which it popped…was based heavily on fraud in the financial sector. Don’t lay all the blame on Dems.”

There may have been fraud involved but you could not prove that by the number of people tried and sent to jail. The easy money policy of the Federal Reserve has a lot to do with bubbles since money created above and beyond what it would be without the Feds interference tends to be mal invested.

It is rather obvious that the banks were encouraged by the the government to produce loans for those who could not afford them. The reason those people could not afford them was after the fact when the prices of houses quit going up. Do you really think that the Federal Reserve and those politicians on the banking committees like Barney Franks who regulate banks were not aware of what was going on. What is the Fed doing currently in buying up mortgages with money it is printing?

Banks are not going to expect to loan money to people who are going to default as that is a losing proposition all the way around. Now a bank might do that if they felt the government would bail them out if a risky investment, or a sufficient amount of them, failed. Now whose fault is it when people accede to moral hazard.

Yes, few to none in jail over the fraud, but several billion have been clawed back on the basis of fraud already, and the private investor lawsuits are just ramping up. The story isn’t over yet.

as always, excuse my spelling and grammar. They were overrated even before the internet, and now are nearly optional in such forums. (only half joking)

Hi Jeremy, I may well be retiring out of the country as well–in my case it’s due to a series of poor decisions earlier in my life.

A little pontificating here… it seems pretty clear to me that Keynes was right in theory but never gets tested in practice. He said we should save money (run a surplus) when times are good and borrow money to keep the wheels of the economy turning when times are bad.

But Democrats can’t normally keep their hands off the surplus in good times, so spending rises. And Republicans fight tooth and nail for austerity at the worst possible point in the economic cycle.

But I think Keynes is right…

Returning to the household analogy.

A financially well-run household BOTH:

1) Saves money/food/assets during the good years.

2) Cuts costs dramatically during the bad years.

More importantly, when a family hits bad years, what do the breadwinners do? They look for jobs anywhere they can take it, they lower their standards if they need to.

Keynes was at least half wrong, using the same analogy you used before. A well-run household cuts spending dramatically to survive the bad times. Keynes believed that government spending was the only method by which money could be stimulated to flow again. I find this to be very shortsighted. There’s lots of ways to get money to flow again, most notably embracing deregulation. The democrats seem hell bent on enforcing more and more regulation of American industries, even in bad times. This behavior raises the standards by which income can be generated, it does not lower it.

Hayek said quite notably that companies and economies don’t respond to financial crises well because wages become STICKY. Give a man a chance to keep his job for lower pay and suddenly companies become profitable again. When you throw in taxes on both employee and employer that are tied to wage level, you get an even larger problem. The U.S. has been operating on borrowed time on the world labor market. Our labor costs have been SKY HIGH compared to the rest of the world for 40+ years. Without massive deregulation and labor market freedom, the U.S. economy will never recover to what we’ve come to expect. We’ve been fearing depreciation of our currency for decades when we should have realized that currency (read: wage) competitiveness is what keeps industry in your home country.

Tom: “it seems pretty clear to me that Keynes was right in theory but never gets tested in practice.”

I’m not sure that any government — not just Democrats — can keep their hands off the surplus in good times. There are three possible reactions to a surplus: save it, increase spending, or reduce taxes. From Congress’s perspective, saving doesn’t win any friends. Reducing taxes brings smiles to voters’ faces. But, being (generally) spread broadly, I think that reduced taxes do not garner as much favor as increased spending, which tends to be more focused.

Take, for instance, Congress’s recent extension of wind power subsidy. $12 Billion over 10 years. Works out to about $10/year/household. [Not that each household pays equally, but just trying to get the right order of magnitude.] Not a huge deal for most folks. But for the 75K workers in the wind industry, they now may well believe that their jobs were saved by the Democratic Party. [Although the provision was supported by Congressmen from both parties whose states have a large stake in wind, as far as I can tell the only opposition was from some Republicans.] Not to mention the owners of those wind companies, and their lobbyists.

Now I realize that this instance can’t be used as an example of your premise — namely what happens when there is a surplus. But the point I’m trying to make is that spending gets a strong response from the beneficiaries of that spending, while reducing taxes has a much more subdued effect on the (far larger number of) taxpayers. It can’t be too surprising then that Congress tends to prefer the spending option. [I suppose the same argument can be made for narrowly-focused tax cuts, and that may help to explain the inordinate complexity of the tax code.] One ends up with a lot of special interest groups, each one smiling at its government-granted boon and not noticing the thousand small cuts inflicted to support all of the other special interest groups.

As an example of what you say…

California had a brief period between 2002 and 2006 of budgetary growth. What did the democrats in control of california do? They outspent their own budgetary increases by 2 to 1 or greater. I’m not exagerrating, they literally increased their deficit spending while given their best chance to buy down debt.

So did Gordon Brown in the UK the worst chancellor and prime minister the UK has ever known, a miniature pygmy amongst towering dwarfs. Such is the state of British and European politicos.

Jeff, as nice as you or I may think Tom Fullers is, what he says in the post in the introduction of this thread is just the wishful thinking of someone in love with big government who has not yet had to come to the realization and grips that we cannot afford the government we now have. Keynes was able to attract a lot of politicians to his otherwise seemingly contradictory ideas because he made what politicians had done in the past to grow government appear economically legitimate. Anyone with a wit of practical sense would know that politicians of before his time, his time and today do not save for a rainy day. The proof is there for anyone to see – if, of course, they really want to look.

If the interest rates on our debt were not tied the safe haven concept of the US, our past performances and that other governments in general being viewed as more reckless spenders than us, we would have much higher rates and be closer to the fate that Greece has had to endure – with that being that a government no longer can meet payments on its debt.

Obviously those who avert their eyes from our debt often neglect to speak about the unfunded liabilities of our federal, state and local government. Are our state and large local governments seen as too big to fail when their unfunded liabilities come due and they can no longer borrow or print money as the federal government can? Does that mean that their debts will be added to the federal debt? What about the many other moral hazards that we potentially now have based on the government’s willingness to bail out financial and auto interests in the latest past crisis.

Obviously when we plied up large federal debt in the past our unfunded liabilities were much smaller and ongoing obligations for federal funds were much smaller. When debt grows and taxes grow with it, the economy suffers and the hoped for ability to grow ourselves out of debt quickly fades. Europe is facing this problem and to a lesser extent so are we in the US. The prime example of this effect is Greece where debt obligations have put that nation into a long term economic funk.

Greece presents another example of things to come for other nations including the US and that is that their citizens are very reluctant to give up even small portions of the government largess they had come to expect to receive. People here in the US have come to expect the benefits of Medicare and Social Security and unfortunately depend, in too many cases, entirely on it. For those who want to deny our shaky financial condition and use the old adage of all that SS and Medicare require is some minor tweaking should think again and then attempt to remember why any changes to those programs has been aptly named the third rail of politics.

“The people who are lending us money are in line to do so.”

Our financial advisor explains this by saying the US is “the best looking horse in line at the glue factory”. We are not really a good investment, but other countries are (amazingly) worse places to put your money.

HUH…

I always thought the expression was “brain scientist”.

A simple way to look at the debt problem is to consider that based on the projected growth of government spending, inclkuding social programs, interest payable on federal debt will exceed projected tax revenue by 2025 according to the 2009 Government Fiscal Commission Report and since then the deficit increase has accelerated. Not only that, interest rates are at all-time lows, should the interest rates return to the historical levels of 5% or 6%, the problem increases exponentially. There is no way to solve the debt crisis by tax increases, alone. Let’s do a mind experiment:

Let’s tax the top 2% of income earners at 100% of their income, enough money will be raised to run the governnment for 3 1/2 to 4 months, what about the other 8 months, who gets taxed next??

Okay, next, let’s tax the Forbes 400 richest people at 100% of their assets. Total net worth of this group is $1.7T, approximately the amount that the debt increased in 2012. Next year, debt goes up by more than $1.7, the year after, more, etc.The Forbes 400 have no more assets since we already taxed them at 100% of their net worth, whose estates get taxed next?

Finally, let’s tax US businesses at 100% of their profits, which in 2011, were approximately $1.7T. If the businesses pay 100% of their profit in taxes, how much can they invest in their enterprise and how many employees can they hire and give jobs to?

It is a fact that as tax rates increase, rich folks find ways to move their money to reduce their taxes so tax revenues may actually go down making an untenable situation even worse.

No matter how you slice it, cuts in spending have to occur if our country is ever going to reduce the national debt and be on sound financial footing, again.

Jeff,

Thanks for doing all that hard work. I will be relying on this post for months or even years to come.

Bush II and Obama have been amazingly successful at emulating the European welfare states. Now why would anyone want to emulate a model that is failing almost everywhere?

Greece is surviving on hand outs from Germany but even so there is blood in the streets.

Greece is just one of the PIIGS (Portugal, Italy, Ireland, Greece & Spain), a group of nations in imminent danger of economic collapse. It will be interesting to see how long Germany will continue pumping money into failed economes. The day Germans say “Enough” the whole stack of cards will come tumbling down.

Then there is the UK, my homeland, that is applying “Austerity” so the people are being forced to pay a much larger percentage of the cost of any health care they receive. Some services that used to be available for a nominal “Co-payment” are now 80% charged to patients.

Countries that embrace the “Welfare State” concept eventually run out of money and find themselves unable to maintain public order which is the main legitimate function of government.

Unfortunately, one of the defects of democracy is that the people can vote themselves all kinds of entitlements that will survive until bankruptcy intervenes.

Another cautionary tale from the UK where the “Politics of Envy” has been flourishing for over 40 years.

In the interest of “Fairness” (does that sound familiar?) taxes were raised on high income earners in the UK.

If the object was to punish success it worked. If the object was to increase government receipts it failed dismally:

http://dailycaller.com/2012/11/28/as-uk-millionaires-flee-country-over-tax-hikes-british-treasury-loses-billions/

I don’t follow many of the things being said here–sorry for my obtuseness. What on earth does the U.S. have in common with Greece? We have our own currency, for gawdssakes. We’re big. We make things.

How come I haven’t seen anybody talking about the insane amount we spend on our military? I’m a proud veteran and support our military, but it’s too effing big.

Does anybody here get that the 39.6% tax rate that Clinton had for top earners is a wee bit different than the 75% the French impose and whatever ridiculous rates the English are using?

C’mon folks–we can do better than this, can’t we? Jeff’s post is good. We can try and meet his standards here…

Well, that came out all wrong. I didn’t mean to be antagonistic. I’ll try again tomorrow.

“C’mon folks–we can do better than this, can’t we? Jeff’s post is good. We can try and meet his standards here…”

Tom, I’ll start with this rejoinder of yours and then go on to your other replies and note that you appear to be spewing clichés.

“I don’t follow many of the things being said here–sorry for my obtuseness. What on earth does the U.S. have in common with Greece? We have our own currency, for gawdssakes. We’re big. We make things.”

Tom, it is not sufficient to say we (the US) are big and we make things and that somehow is how we will avoid the fate of Greece. Greece borrowed because as part of the EU there was the moral hazard that the EU (Germany) would bail them out and that kept borrowing costs artificially low. When people had second thoughts about that bail out because the EU nations were having financial difficulties suddenly the interest rates increased and the principle and interest payments were difficult to impossible to make. The US also benefits from artificially low interest rates just like Greece but for different reasons. When the lending public gets a whiff of the fate of the US if those rates climb and that the Fed cannot sustain them at low levels our borrowing cost can increase dramatically. Currently like the housing bubble it is feeding on itself and it is not sustainable – but we have plenty of people such as yourself unable or unwilling to recognize the situation.

“How come I haven’t seen anybody talking about the insane amount we spend on our military? I’m a proud veteran and support our military, but it’s too effing big.”

Defense spending is a significant part of the big government that we can no longer afford or sustain. The more critical question is why a liberal president has not made initiatives to make dramatic cuts in defense spending. We currently still have military troops in places like Germany, Japan, and Korea. I guess the Keynesian/liberal Democrat hesitancy is that cutting the troops would add to the employment rate. Our government is too effing big and the military is symptomatic of that problem.

“Does anybody here get that the 39.6% tax rate that Clinton had for top earners is a wee bit different than the 75% the French impose and whatever ridiculous rates the English are using?”

What I get is that big government advocates in reality care less about were the revenue comes from but rather it is a matter getting it somewhere and that starts with the sources that expend the least political capital, like the individuals with the greater incomes and lesser voting power they have and the sin taxes that affect the poorer more and because we have a Puritanical streak that makes those taxes less onerous to the voting public. We tax the faceless and vote-less corporations and businesses that in many instances can pass that cost on in higher prices to the naive consumer.

I saw a CNN commentator go ballistic over a comment Rand Paul made in comparing the US to Greece and he spouted some clichés about the US just as you did, Tom. He even faulted Paul for his comments in that it might initiate a crises. The economist to whom the commentator spouted replied that maybe Paul should be listened to since the financial path our federal government is on is unsustainable. Maybe you should listen also, Tom, but I’ll not hold my breath.

Hiya Kenneth

I would prefer lower taxes and lower spending. I would prefer that we do not spend more than we take in. (I recognize that you and I would probably make different choices on how to get there, but honestly I would be happier with a balanced budget, low taxes and tight controls on spending.)

But in all honesty, I do not see anything unsustainable in what we are doing now. Not in real numbers, not in percentages, not in terms of mortgaging our future.

My problem is that we are not preparing for expenditures we will want to make in the future.

Thomaswfuller2 said: But in all honesty, I do not see anything unsustainable in what we are doing now

But consider our national debt from a different perspective. You are unhappy with the military spending (may actually be too high), but last year with record low interest rates (avg rate for the govt in 2013 was 2.79%) we paid $365B in interest alone. When (not if) interest rates return to their normal range of about 4.6% (averaged over the last 14 years) our INTEREST payments will be $765B on our CURRENT debt. If rates slip back to the end of the Clinton era, 6.54%, then our INTEREST payments will be over $1T on our current debt. Can you honestly believe we can ever afford even the interest on our current debt when the recovery starts? when interest rates go up, and they will, we will be Greece. We will be unable to pay our debt. Now think about the $5T that will be added to the debt in Obama’s next 4 years. Suddenly we are looking at interest payments (not principal, interest) on $22T. Pray really hard that interest rates never reach the 1979 levels of double digits.

We have a spending problem, not a revenue problem.

The percentage of the federal budget spent on defense is like 20%.

The percentage of the federal budget spent on social entitlement programs is about 60%.

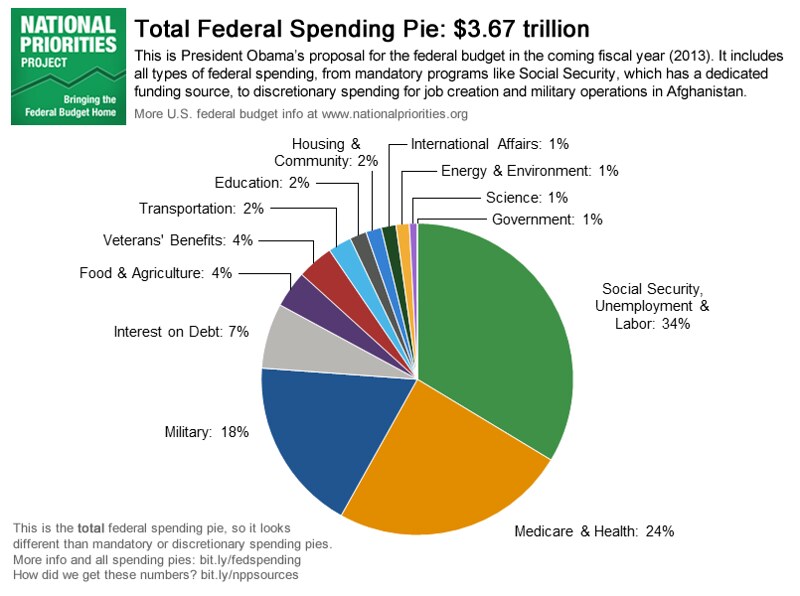

Now, what people like to show everyone to “prove” that our military spending is too much is a plot like this:

Which is a pie chart of all DISCRETIONARY spending (spending that must be justified before congress each year), however, that’s only a smaller portion of the total budget.

What they should be showing you is this:

which shows quite clearly that all entitlement programs, medicare, medicaid, social security, unemployment, etc… take up 58% of the federal budget for 2013 (proposed)

While military spending takes up maybe 18%

Now, please consider what we get for our dollars. When you spend money on the military, you get technological innovation. Defense spending has ALWAYS attracted the best and brightest minds to develop military weapons and sensory systems that push mankinds technological boundaries. You can lump in most of NASAs early years into that as there were political-military reasons for the moon program. In short, spending money on military defense programs is an investment in our future, and provides lots of great entry-level jobs for science, engineering technology, and math majors. This in turn encourages young people in the U.S. to go for useful college degrees.

What do we get from throwing money at the unemployed? What do we get from throwing money at those who failed to save for retirement? what do we get for giving money to those who don’t take care of their health?

We get nothing but expenditures. Taking care of the sick and underperforming is only a drain on our present and future, there is no net benefit save keeping people alive for doing nothing.

Actually, what people should be looking at wrt defense spending is this: http://www.rickety.us/2011/01/2009-defense-spending-by-country/

Some things are best discussed with percentages of GDP. Others are not.

Some things are best discussed with percentages of GDP. Others are not.

That wasn’t percent of GDP, that was percent of total expenditures which is a very different number. And comparing the U.S. to other countries is a complete conflation of numbers considering at least some of those countries benefit from our own military presence in their country. This fact raises our total expenditure and pushes theirs down. So exactly how is it more appropriate to compare us to other countries, particularly China which has a less-than-transparent government that is likely lying about how much they spend on defense.

Returning to the household analogy yet again, what do you spend on protecting your family from the elements (weather/disaster), theft (security), and general well-being so they can sleep at night? Most people would acknowledge that owning a home or having a place of residence is the primary factor towards protecting a family from these things. Most families can spend 25-50% of their income on their home, security, etc… Why is it then strange that a peacetime superpower who helps protect numerous allies, spends 25% of it’s budget on defense, most of which spurs innovation for future consumer goods?

I noticed you made no excuses for the 60% spending on social entitlements.

I make no excuses for spending on social entitlements because I don’t think they need to be excused.

China lies about its defense spending? I’m shocked.. tell me again about our black budgets for intelligence spending and which arm of our government handles Predator launches against the Taliban?

And I think you are confusing the actors in this analogy. Of course a household spends lots of money on those things. I’m comparing the government to the household. Now I know you are thinking the government gets money apart from the household and I’m not arguing that. But in my analogy the government is the household…

Those budgets, by the way, unlike social security, unlike medicare, unlike all social spending, must be reviewed by congress every year. That’s right, no one takes a hard look at the progress or laziness or wastefulness of social programs each year, that money is simply spent. On the other hand, ALL classified military programs are in danger of cancellation if they fall behind schedule or go over budget. That’s simply a fact.

I’m not confusing actors, you have called out military spending as being TOO HIGH. I’m telling you we spend 3 times as much on social programs, and social programs have no long-term return to the country. Now exactly what are we spending too much on?

Oh wow !!!

Look at how much GDP whogivesarataboutitstan is spending on their own national defense !!!

Just for fun, could you please tell us of the 800 BILLION dollars of the 2009,2010,2011,2012 stimulus money goes to defense?

By the way,is case you didn’t know, it’s 800 BILLION a year

I have to agree Thomas Fuller when he says US military is too high. I think it was a military man (Eisenhower) who warned us against the “military industrial complex”. While Eisenhower had the right idea his aim was a little off on the occasion of his farewell speech. Just to get a sense of where the real problems lie please check out this link:

http://www.usgovernmentspending.com/past_spending

Currently military spending amounts to around 6% of GDP. With no hot wars in progress spending should be trending down as in fact it is.

If you think military spending is too high, what do you think about health care spending? Currently health care amounts to 18% of GDP or three times our military spending. By 2016 when Obama leaves office, military spending will be 4.5% of GDP while health care will account for ~20%.

While we need to spend huge sums on both our military and health care there is one huge difference. Military spending is under control while health care spending is not.

Thomas Fuller asks “What the USA has in common with Greece”? Simply put it does not matter how big your economy is if you can’t meet your obligations.

The economy of Greece is small enough to be “Bailed out” by Germany. When the USA fails to meet its obligations there will be nobody with enough money to bail us out. When it happens we will have one thing in common with Greece……blood in the streets.

Mr. Fuller is being absurd. There is a huge difference between borrowing money to pay for a war (an existential issue at the time) and borrowing to keep poor folks in cell phones. It’s like Twain says: if a man can’t deceive himself, who else is he going to deceive? I’d also like to know when abject fiscal irresponsibility became a part of left-wing dna.

Hi George

The disparity between our spending on defense and that of other countries has nothing to do with our recent wars. We really do spend more on defense than the next 10 countries and have for decades–with or without wars.

As a liberal Democrat, I’d also like to register the ritual objection to labeling the Iraq war an existential issue…

Hi, Tom,

I misread you. I thought you were referring to the relationship between debt and GNP as a result of government spending for World War II. You and I are on the same side of the picket fence when it comes to the Iraq War, which is in no way an existential war. I would add that the US spends a lot on defense, or more than we should, because some nations (Europe) rely on us to defend them.

Hi George,

Europeans indeed get a free ride on the back of our defense expenditures. But didn’t we sort of go right up to them after the war and present our semi-permanent European presence as a fait accompli? I don’t recall us offering the Germans a choice on Mannstein…

If you proposed that we revisit our extended foreign basing policy in light of changes in world affairs, I would happily agree.

Tom,

I enjoy your presence in these debates. You never speak intemperately and always manage to help everyone keep an eye on the ball. A class act through and through. About those bases (in Europe & elsewhere)? I have never been able to understand why many of them are still there. Most should be closed. In fact, I’ve been advocating a US pullout from South Korea just about all my life.

Margaret Thatcher said:

“The problem with socialism is that eventually you run out of other people’s money [to spend].”

Rather well-stated, I think.

Hi Chuck

I’m not a socialist. I’m a Democrat. I believe our country is stronger if we do spend some of our wealth on helping the poor and the sick.

I’m not an idiot–I know a lot of the money is wasted (although I think waste is more common in defense spending). But I think Governor Christie’s dilemma should be clear to all. Social spending is not popular with conservatives–until suddenly it is.

I honestly think we should spend some of the money you make to insure institutions like FEMA are able to minimize and recover quickly from the damage caused by natural disasters, whether or not you agree. Whether or not some of it is wasted. Whether or not you live in an area rarely touched by natural disaster.

What we’ve been discussing so far is how much…

Tom, I didn’t mean to imply or suggest that you were, if that’s what you thought, please accept my apology. I believe the quote states the problem with out-of-control social welfare programs, as we see happening in Greece, Spain, etc.

Do you believe that 60% of the federal budget is too much? too low?

Returning to the household analogy, do you know of any households that spend 60% of their income helping the poor yet still manage to raise well-fed and well-educated children? I don’t. At best I’ve seen people who spend 10% of their income, if that, and they don’t have kids.

Hi Jeremy

Analogies shouldn’t be stretched too far. But to reconstruct the analogy a bit, I do believe that many households spend similar percentages of their incomes on raising their own children and helping their families prosper. You I believe are confusing income streams in what is apparently becoming an increasingly tortured analogy.

If you want to construct the argument that way, by all means. Lets pretend the children of a family are the poor. This would make unemployment insurance the money given to children when they’re out of work and must move back home. This would make health care the money spent on them when they get seriously injured and have no one else to care for them. This would make social security the money the kids spend keeping the old-folks alive I guess?

If we’re spending 60% of our total budget on those things, it sounds like:

1) We failed to educate our children properly so they could get jobs, or we made no effort at finding them a trade.

2) We did not teach our kids how to eat properly and excercise.

3) We let grandma loose in vegas with her retirement money.

Which, unsurprisingly, is extremely apt for what this country has actually done.

When times get tough, do you tax the car more and let the house maintenance go by the wayside, the things that are required to keep the income and family structure going? Or do you tell those in the house who are mooching that they need to reduce their living conditions further?

Hi Jeremy

For the first 17 years of my life I was one of five children living in a household with one income earner–my father. The household income indeed fed and clothed us, insured us, kept our teeth in shape and a roof over our head. The income was adequate to send my older brother to law school. Sadly, there wasn’t enough left over for my education so I joined the Navy and started sucking at the government teat, or whatever you want to call it.

My father’s hard work also extended to helping my mother’s parents financially. They were in Oregon, not Las Vegas.

My father is now 85 years old. He’s writing another book–about prison reform and the people who made it happen. In all the years I have known him, he has never once complained about the burden he carried. I think he thought it was part of the deal.

I tend to think he was right.

How much of the people’s wealth should the state collect in taxes and spend as government officials think fit?

Gerard Depardieu thinks that 75% is too much–and I agree. France currently collects about 54% of GDP to the bosom of the state. (I must say, even if it’s too much, the French don’t really agree, probably because the French state does a pretty good job of spending this money intelligently.)

But Depardieu decamped to Belgium, which collects 47% of GDP in taxes. He didn’t come to the U.S. to escape the tax man, as John Lennon did in the 60s.

Somewhere between the United Arab Emirate’s 1% of GDP and Kiribati’s 70% of GDP is probably a happy medium. I would submit that your personal physical and financial condition will shape your preference more than your nationality or political party. I would offer Governor Christie as the reason why.

Jeff wrote above that there are ‘several’ countries that collect more in the way of receipts than the U.S. The Heritage Foundation lists 61.

Jeff also wrote that it was easy to see where increased revenue came from–but he fails to note that social security and healthcare taxes have climbed from 2% in 1940 to 7% of GDP today.

Do we want to live in a country without unemployment insurance? Social Security? Medicare? Medicaid? I vote no.

I’m willing to work with conservatives on fighting waste and corruption–hell, we liberals need you conservatives to keep us honest when we are in power (and we’re happy to return the favor when we’re not). But the overall structure of the U.S. social safety net looks sound to me. I think it could be stronger in some areas.

I do not think our tax burden is too high.

I don’t want to live in a country where despite my own sacrifice, merit and industry, I am forced to subsidize the life of those who want to be lazy.

You can have all the social programs you want, as long as the contributions are voluntary. By forcing everyone to pay for others lack of motivation, you destroy any incentive to be profitable, particularly when this taxation of the profitable ramps up as you become more successful.

Hi Jeremy

Well, I would highlight the recent experience of Governor Christie as an argument against you. He was against Federal spending of the sort that he is asking for now.

I would also say that he’s a politician, and politicians bend with whatever wind is blowing. I also laugh at his screams for federal aid, since allowing people to build high-value properties on sand-bars on the Atlantic coast was foolish to begin with. Florida learned this long ago. By and large, the majority of damage done by that tropical depression (not hurricane, not tropical storm, barely a major storm) was because high-value property was allowed to be built on unstable ground.

It would be just as ridiculous if California’s governor demanded federal aid to subsidize the wealthy who build their homes on unstable sandstone cliffs along the pacific ocean and had their homes washed away by storms… yet as blue as California is, I’ve never seen this happen.

But our taxes do help rebuild Malibu millionaire homes after fires and earthquakes. It’s just hidden better.

No comment on the absurdity Tom? Just a counter-point that other people do it, so it must be okay?

Tom… watch this video and tell me what you think.

Jeremy, on occasion the government has supported me with your taxes–thank you. I wish that had not been the case and my overall contributions have exceeded my takings, but them’s the facts.

For the record, I have never appeared on Judge Judy’s show.

Your thank you is unnecessary and unwanted. Give me freedom from contributing to causes under pain of imprisonment or garnished wages, and you might gladly receive my help.

How much debt should the government carry on its books? This is a question often discussed by economists and it seems that the answer differs from country to country. Which makes sense to me…

The answers I have seen suggest that debt should fluctuate over the course of the economic cycle and that looking at debt as a snapshot percentage of one year’s GDP is not very helpful. If you look at the recent troubles experienced in Europe, Greece always looked like a disaster waiting to happen, but Ireland, Spain and Portugal did not. It wasn’t public debt that got them in trouble. It was the banks in Spain and Portugal and a housing boom in Ireland.

What I believe is that the best way to crawl out from under a pile of debt is to quickly grow your income. I believe in this country that Democrats have a better track record of doing that. I don’t think current debt is a serious issue–if it were, Treasury prices would reflect it. I think Democrats in this country have a better handle on the scope of future unfunded obligations and understand that unless the economy returns to robust growth, we are in for big trouble. I think Republicans are too married to the idea of short-term tax cuts to be of much use in this matter.

But heck–I’m a Democrat. Of course I’d say all that. It just happens to be what I believe to be the case.

Tom, the Chemical Bank of America did a study that showed that economies tended to do better under Democrats than Republicans. It only went to Clinton’s admin.

The current problem for both Democrats and Republicans is that the tax policy has been more about partisan positions than economic realities. That is why George W’s policies did poorly. At the time the Republicans were hawking about reducing capital gains and taxes on the rich, the economic reality was that manufacturing had about a 10% surplus of capability. The proper strategy would have been to reduce taxes on middle and low income groups and actually increase capital gains taxes, and taxes on the rich as to send incentive towards purcahsing, not investing.

Obama and the Democrats have tending to do the opposite incorrectly as well. If there is insufficent capacity, but excess demand, it pays to decrease capital gains and taxes on the rich, and put taxes on the low and middle income instead, as well as cut social benefit packages.

It is not that government cannot help the economy, it is that political posturing and buying of votes is done by both parties to the detriment of all.

As it happens, Kevin Drum is talking about spending today. He focuses on Federal spending but it’s still instructive:

“Ever since Ronald Reagan first said it, Republicans have been fond of insisting that “we don’t have a revenue problem, we have a spending problem.” But it turns out that isn’t true. Let’s take a look at the raw data.

Spending first. In 1981, when Reagan took office, the federal government spent 22.2 percent of GDP. That figure dropped steadily for the next two decades, and by the year 2000 spending was down to 18.2 percent of GDP. Expenditures went up after that, but the Office of Management and Budget estimates that by 2017, spending will once again be 22.2 percent of GDP, exactly the same as it was 30 years ago. In other words, spending hasn’t gone up at all.

But even that overstates the problem. The chart below shows federal spending since the Reagan era. You’ll notice a few things:

There are always small spikes during recessions. You see them in 1980, 1990, and 2000. This is perfectly natural: when the economy is bad, the federal government spends more on unemployment insurance, food stamps, Medicaid, and other forms of aid.

The first serious upward spike in spending came under George W. Bush and a Republican Congress. They were the ones who decided to fight two wars, enact a big Medicare expansion, and increase spending on other programs, both domestic and defense.

The other big upward spike came in 2008, and it was purely a temporary result of the Great Recession. This doesn’t show that spending is out of control, just that the 2008 recession was bigger than any since the Great Depression.

But even with the 2008 recession, federal spending is still on track to be lower a decade from now than it was when Reagan took office. More details here. The plain fact is that spending simply hasn’t been our big problem over the past three decades.

So how about tax revenue? The basic chart is below. It shows that tax revenue was 19.6 percent of GDP when Reagan took office, and it’s projected to be 19.2 percent of GDP in 2017.

The facts are pretty clear. Spending isn’t our big problem. The recession spike of 2008 aside, it’s about the same as it was 30 years ago. But instead of paying for that spending, we’ve repeatedly cut taxes, which are now at their lowest level in half a century. Tax revenue will go up as the economy improves, but even five years from now it will still be lower than it was when Reagan took office.

So what’s our real problem? That’s simple: America is getting older and healthcare costs are rising. That means we’ll need to spend more money in the future on Social Security and Medicare. There’s simply no way around that unless we’re willing to immiserate our elderly, and that’s not going to happen. Not only is it politically inconceivable, but the truth is that even Republicans don’t want to do it, no matter how tough a game they talk. Like it or not, this means that over the next 20 or 30 years, spending on the elderly is going to go up by three or four percent of GDP.

This is where we stand. Spending in general has been well controlled for the past 30 years, averaging about 21 percent of GDP. With good management, that might go down a point or two, but certainly no more. Probably the lowest we can realistically hope for is about 19-20 percent of GDP. Add in the increased spending on the elderly, and federal outlays are going to be in the neighborhood of 23-24 percent of GDP by around 2030.”

http://www.motherjones.com/kevin-drum

Tom,

Are you saying figure 2 is wrong?. It shows that we are outlaying more today than we did at the height of WWII – over 35% just in on budget spending.

I would have agreed with that before this post, but the graphs of the data show the situation differently. GWB increased total dollars but ended up increasing the total outlay as %GDP only very slightly. It wasn’t until the Democrat congress convinced him to bail out the economy with massive programs in his last 2 years that the jump happens. — I’m still pissed about that.

This is inaccurate. Spending went through the roof with Obama’s first bill. Check figure 2 of this post https://noconsensus.wordpress.com/2012/03/17/conservative-fantasy-world/ Note the spike when Obama took office. Remember how the “bailout” was full of corrupt payoffs to campaign contributors and new programs. He created a huge spending increase, which the health care bill will continue to expand. If you look at the numbers as I did, my recollection is that about 50% came from reduced income and 50% from increased spending.

In the year 1980, we were below 30 percent GDP, now we are over 35% – this doesn’t include state tax either.

I saw the link to Kevin Drum’s blog and his data does not appear to be accurate either. If we are going to have a meaningful discussion, we need to agree that the data is accurate before making conclusions. I have done some checking of the data used here and I believe it to be accurate. If you request, I can look further but it seems fair for you to find the source of Kevin’s data then.

As harold points out below, that does include state tax so I misspoke saying it didn’t include state tax. That doesn’t change a thing about my reply and it should still change Tom’s answer.

Jeff,

Tom’s (well, Kevin’s) figures are for federal spending; your figure 2 covers government spending at all levels. That’s at least part of the discrepancy.

Thanks

Jeff, Tom before you accept any of these numbers or graphs, you need to check the 1983 OMB report. By executive order of Ronald Reagan, the US OMB was charged with using unacceptable accounting practices. The last time I checked, Clinton had proposed on going back to generally accepted accounting practices until he was shown what that would do to his supposed wonderful economic leagcy. With the problems the US economy has had since, I do not think we gone back to accepted standards. I could be wrong. I haven’t checked. I know in the Clinton years, when the Alan Greenspan of the Fed came in to discuss social security, he noted that use of proper accounting for social security would put the balance sheet into unacceptable regions for money lenders, and that although the social security debt was not a guaranteed debt legally, it was politically. He then sold a load of BS to Congress and the President on how we could continue not balancing the books and just postponing it to future politicians. Somewhere his written testimony is on-line and somewhere there is a critique of it that is well worth reading. You may need the wayback machine though.

Hiya Jeff! Looks like a real discussion here!

Your figure 2 has local and state spending. Drum’s is Fed only.

On Drum’s chart, the GW Bush ‘spending spree’ shows as a very modest increase percentage-wise, so I don’t think there’s much of a difference between his figures and yours.

Spending went through the roof in Obama’s first few months because of bailouts passed during GW Bush’s final months in office–and a good thing, too!

Maybe my eyesight is going, but it sure looks to me like 1980 spending is below 30%. (That’s why I like tables more than charts… getting old…)

“Spending went through the roof in Obama’s first few months”

True, and some of it actually went to something that made a difference (though most did not). The problem is that it has only climbed since then. It is only because of the record low interest rates on our national debt that it is not the largest line item in our (non existent) budget. Interest payments are tax monies that do not provide food stamps, or unemployment, or fuel for our military equipment, or welfare/medicare payments. If you believe in God, pray hard that we never see interest rates in the double digits again, because if that happens we will be Greece. The Federal funds rate in 1980 was 20%, that would mean interest on our current national debt of over $3T.

Whoops! My eyesight really is going! I misread your comment. Yes, combined fed, state and local is above 35% now. But again, Drum is looking only at Federal.

You wouldn’t believe the tax load on a manufacturer. We pay well over 50% and because of the required re-investment, my functional tax rate is in the hundreds of percents of my takehome. I literally write checks to the government that are far bigger than my annual take home salary but cannot take home the business cash as it is required to operate the business.

And Obama just needs a little more.

My points all stand. We are paying higher tax than any time in history. Manufacturers in particular face punitive taxes. The debt is massive compared to income and because our spending has exceeded WWII levels, with no end to the commitments anytime in the near future, America is in a great deal of trouble. The recession was responsible for about 50% of the deficit increase under Obama, not all of it, and the locus of possible interpretations cannot include that this situation is sustainable for any length of time.

I think military is the wrong area to cut when we have things like DOE, EPA, ATF and the UN to work with, but I will take all of the above with a smile.

Hiya Jeff

Well, I’ll have to look up corporate tax rates in a minute, but personal tax rates are definitely not the highest ever–see here:

http://visual.ly/check-your-us-tax-rate-2012-and-every-year-1913

Here’s what Wikipedia considers effective corporate tax rates: http://en.wikipedia.org/wiki/File:US_Effective_Corporate_Tax_Rate_1947-2011_v2.jpg

Sorry Tom, your use of the second wiki link shows that you are completely unaware of how business taxes work. You also cannot ignore the fact that there are other taxes than income that taxpayers face. Figure 2 of this post is the one you need to refer to because it represents government load on the economy.

We have been over this subject here many times. S corps are owned by individuals, they don’t pay tax. The owners pay on their behalf so all corporate income is reported on shareholder returns. 95% of companies are S corps, only a couple percent of them are functionally profitable to a reasonable level. 2/3 of the wealthy making over 450K, are actually S corp owners. My company income is on my personal return.

In other words, Obama just raised taxes on a huge chunk of the business owners in this country and happened to catch a bunch of lawyers and professional athletes in the mix. The difference is that if a business owner took all of the cash out of their company, the company would close. So for 2012, I will pay a true tax rate on my actual takehome from my much larger, reported-yet-unspendable income, of hundreds of percent – not 20%. I wouldn’t lie to you about this.

Your graph shows type C corporate tax I believe. C corps rates on average are going down because they are often large enough to influence congress and receive breaks. More importantly than that, they have the resources to manufacture in their own facilities overseas and hold profits there. They sell to the US at the highest price the IRS will allow. GE, apple and Microsoft are good examples and guess who they contribute to? This discussion is frustrating for me because you are making the claim that tax rates are lower than in history, which is flatly untrue (Figure 2), and now that the corporate rate is much lower than in the past, also untrue. You are making the claims because you don’t know tax law and because you are preferentially choosing to discuss a fraction of the tax (income only) rather than the total tax paid.

C corps pay tax directly to the government. If a C corp owner later takes money out of the C corp (dividend), they pay full income tax on that money – a second tax – often at that high income tax level. (ouch!!) C corps are designed to live on the exchange with many shareholders and the execs take very high pay. S corps have a legally limited number of shareholders and distributions don’t get a second tax. Shares are harder to sell in an S corp because they are not centrally exchanged so investors are harder to find. S corp historic tax rates are very much incorporated into Figure 2 above. Interestingly, the meat-handed new law means that the tax hikes S corps just experienced, made private companies less competitive relative to giant public C corporations that the left so likes to excoriate. As a ratio, our company pays over 50% of our income in various taxes already.

I’m telling you that these tax rates are suicidally destructive, because I pay them. You don’t have to believe that, but your claims that taxes are much lower than 30 years ago, are not supported by the data (figure 2 is taken from somewhere). 95% of corporations are regulated by individual income tax rates. The code is preferential to service companies rather than manufacturing. Only a few percent of the S corps are making the majority of the income – remember the presidential debates? These corps just received enormous tax increases – in 2013, in the middle of a recession we received increases of 4.9% after 400K of income, 20% increase in healthcare costs, 1% medicare increases, 3.8% increase for any investor profits in our company (e.g. if I or an outside investor work less than 500 hours for the invested company, for whatever reason, you pay an additional 3.8%), 5% capital gains on the sale of any S corp, and a large number of new compliance costs which the left literally never recognizes.

All that and our customers are largely S corporations so orders have dropped about 30% since the election.

I hope you will pay closer attention to what I am writing this time than a Wiki link.

Our taxes are dramatically higher overall than in history-. Remember, what looks like ONLY 5% of GDP, is a huge fraction of profit. In the same manner as the 2.8% tax on gross sales of medical device manufacturers is really a 15%-30% increase on actual income.

Hopefully, you find this informative.

By the way–I would take all of the above with a smile, as well.

Tom, after 4 years, I can say that I don’t take anything in blogland personally. Perhaps I am overconfident and if we were in the same room, I probably would just sit quietly. Engineers often discuss these sorts of details vehemently, many times we find ourselves wrong. In my experience, to an engineer we all enjoy the challenge.

I believe I have provided solid evidence which refutes your tax claims. As a business owner who is being attacked with great vigor by the Democrat party, I do hope that people will listen. I woke up after the recent election and my wife was horribly upset. I told her that I was equally upset, but not for us. We will be fine. In a socialist system, it is the little people, the workers, those without cash or power who suffer. I was sad for those who we worked so hard to help. And that my friend, is the truth as I see it.

Because Drum is posting a lot, here’s the permalink to the specific post I referred to: http://www.motherjones.com/kevin-drum/2013/01/we-dont-have-spending-problem-we-have-aging-problem

Folks, you are making a big mistake in attempting to defend your partisan favorite politicians and allow the debate on the unsustainable debt to have a change in subject. The same goes for looking for nations who are worse off then ourselves and somehow seeing that as a positive for us. It is rather a lesson to be learned. The fact that a governor such as Chris Christy, who some might call a conservative, can have his hand out in a very political move, should not provide anyone with any consolation with regards the debt problem, but rather show that politicians of all political stripes are part of the problem. and that they play the crises game very well.

Only Liberals would call Christy a “Conservative”.

Conservatives would call him a RINO.

Kenneth, what about our current level of debt makes in ‘unsustainable’? I would agree with you if you said something like we cannot continue to increase our debt at the rate we have recently. I would agree with you if you said that we are heading for trouble with regards to Medicare and Medicaid.

But I see nothing about our current $16 trillion in debt that is insane or unsustainable in and of itself. I wish it were lower. But I would lower it by cutting defense spending, anathema to conservatives. They would lower it by slashing social spending, which I will resist.

So it just sits there, a lump of debt. It’s not good. It will constrain our options in the future. But unsustainable? I don’t think that’s accurate.

Again with the imperfect analogy–if a household has an annual income of $130,000 and has debt of $160,000, they can still have a perfect score with Credit.Com. It depends on what else is going on in the household, right?